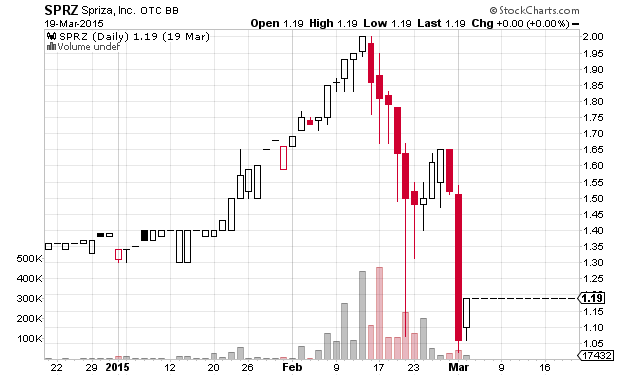

On March 4th the SEC suspended trading in another landing page pump, Spriza (SPRZ). One key insider of Spriza was also involved in Telupay (TLPY) which likely explains why Stocktips.com abandoned that pump after only a week.

SEC Suspension notice (PDF)

SEC Suspension order (PDF)

The SEC was quite specific in explaining why it suspended trading in SPRZ:

The Commission temporarily suspended trading in Spriza, Inc. because of questions regarding the accuracy of assertions by Spriza, Inc., including assertions regarding business relationships in a company press release dated February 6, 2015, a Form 8-K and in a video created by the company.

The Commission acknowledges the assistance of FINRA and the Alberta Securities Commission’s assistance in this matter.

You can read the February 6th press release. The name dropping in the press release certainly didn’t help the company:

“We’re like the Google search engine of contests,” said Spriza’s CEO, Rob Danard, adding the Company which launched in May, 2014 has consolidated contests into one central portal. “How we distribute contests is very similar to how Pinterest or Flipboard displays their content.

Information on the pump is below:

I first received an email promoting SPRZ on February 9, 2015 from Marketing@insiderwealthalert.com and linking to the online promotion page http://streetreview.com/leading-social-networking-company-spriza-sprz-attracts-millions-of-users-with-innovative-search-technology/

Disclosed budget: $175,000

Promoter: Streetreview.com / Financial Times Publishing Corp, Ltd

Paying party: ?

Shares outstanding: 67,618,934

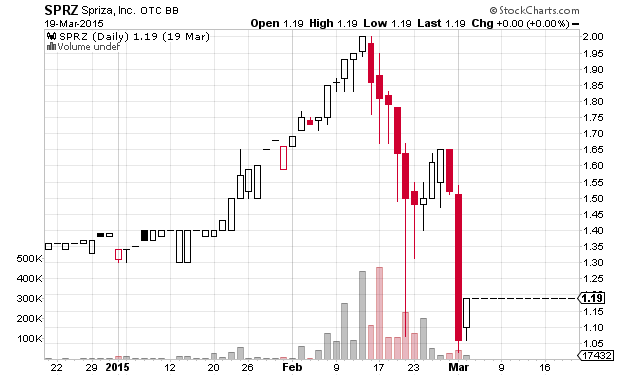

Previous closing price (day prior to trading suspension): $1.19

Market capitalization: $80 million

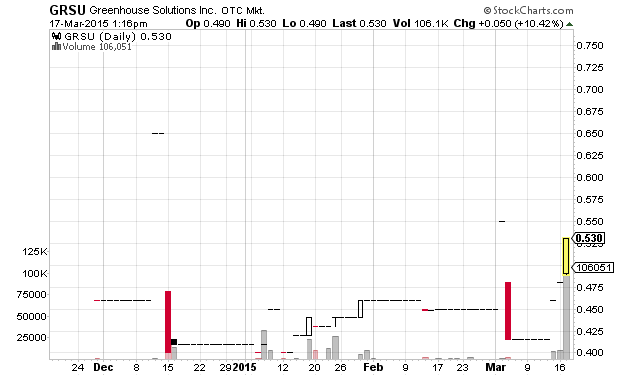

SPRZ 2015-3-20

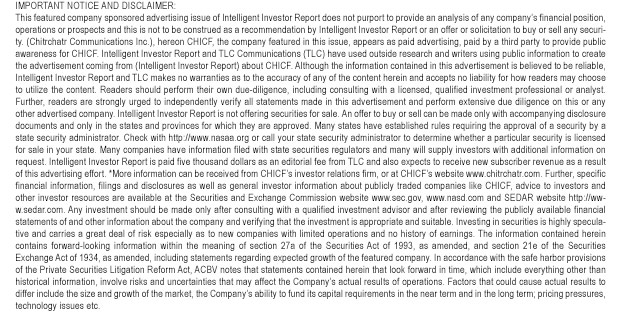

Excerpt from disclaimer:

StreetReview.com (“SR”) is owned and operated by Financial Times Publishing Corp, Ltd.

…

SR and its affiliates have received or expects to receive and manage a total advertising budget of one hundred and seventy five thousand dollars for publishing this advertisement.

Full disclaimer:

Disclosure: These online reports, videos and other content on streetreveiw.com should be viewed as a paid advertisement (“content”). By viewing the content you agree and understand StreetReview.com (“SR”) is owned and operated by Financial Times Publishing Corp, Ltd. who is a publisher of financial news and opinions and not a securities broker/dealer or registered investment advisor. SR does not purport to provide any analysis of any published company’s or their financial position, operations or prospects and the information is often incomplete and should not to be construed as a recommendation of an offer or solicitation to buy or sell a security. While information contained in this advertisement is believed to be reliable, SR and its affiliates make no warranties as to the accuracy of any of the content herein and accept no liability for how readers may choose to utilize the opinions of SR. Further the reader agrees to indemnity SR to the fullest extent of the law in such reliance. It would be prudent for each reader to perform in-depth due diligence, including consulting with a licensed, qualified investment professional or analyst. Also independently verify all statements made in any special reports or other content. SR and its affiliates have received or expects to receive and manage a total advertising budget of one hundred and seventy five thousand dollars for publishing this advertisement. For more information about covered companies readers should complete their independent due diligence at the Securities and Exchange Commission website www.sec.gov and www.finra.org. Investing in securities is highly speculative and carries a great deal of risk especially as to new companies with limited operations and no history of earnings and should not be perused unless the investor is prepared to loose their entire investment. The information contained herein contains forward-looking information within the meaning of section 27a of the Securities Act of 1993, as amended, and section 21e of the Securities Exchange Act of 1934, as amended, including statements regarding expected growth of the advertised company. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act, The Company and its affiliates note that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the Company’s actual results of operations. Factors that could cause actual results to differ include the size and growth of the market, the Company’s ability to fund its capital requirements in the near term and in the long term; regulatory, pricing pressures, technology issues and much more. Got to sec.gov for more information.

PDF copy of promotion page

Disclaimer: I have no position in any stock mentioned. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.