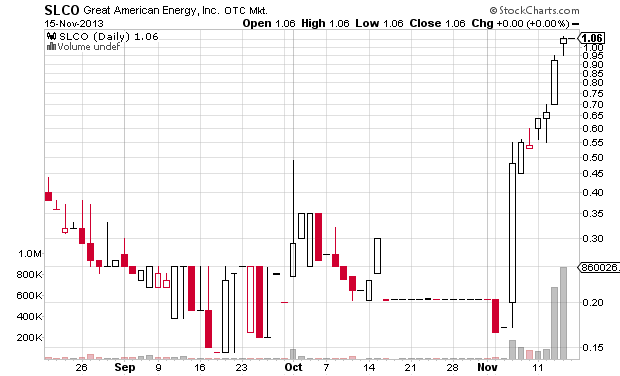

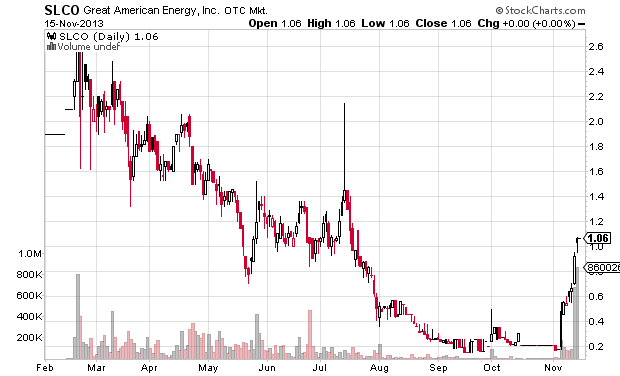

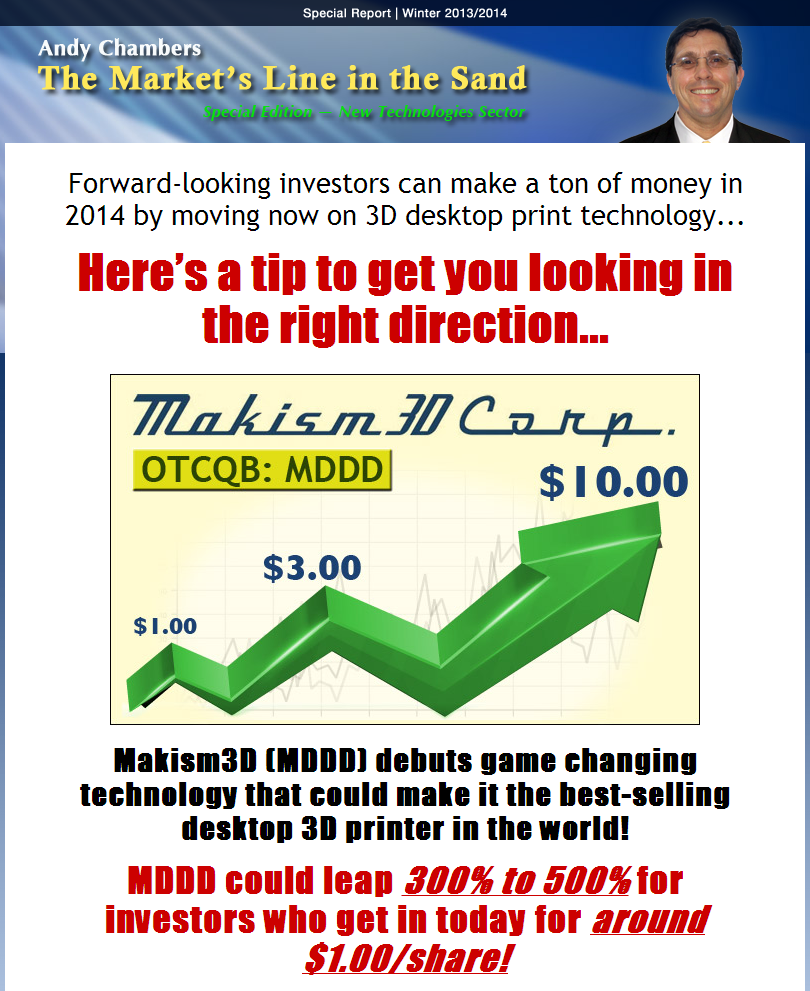

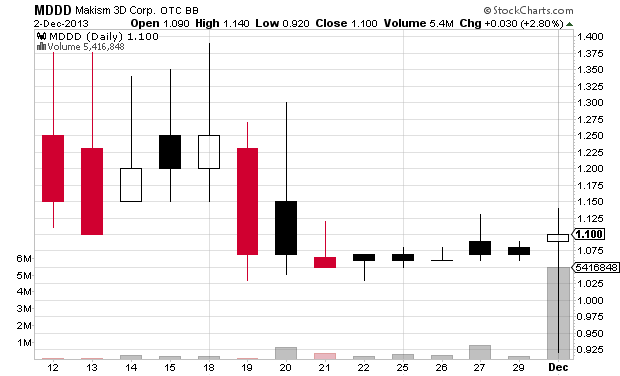

On November 30th I received promotion emails from info@bedfordreport.com, info@paragonreport.com, and info@fivestarequities.com promoting Makism 3D Corp (MDDD). All three websites are owned / run by the same promoters. They do some email-only stock promotions but they also do some promotions that are larger in concert with hard mailers. They promoted ARTH back in July and ECAU back in March. This morning in their emails they gave links to the online landing page http://techpickreport.com/

Below is an excerpt of the disclaimer from the emails:

Providence has been compensated $50,000 by Blackrock Media Group Inc. (hereafter “BMG”), on behalf of its client, Edge Strategies LLC., for a one month advertising contract to build investor awareness for Makism 3D Corp. (OTCQB: MDDD) starting November 30, 2013. In addition, Providence expects to receive future compensation for the continuation of the advertising contract for a minimum of two additional months at $50,000 per month for a total of $150,000.

Disclosed budget: $2,750,000

Promoter: Blackrock Media Group Inc. and Andy Chambers / Chambers Advisors Inc

Paying party: Edge Strategies, LLC

Shares outstanding: 59,210,000

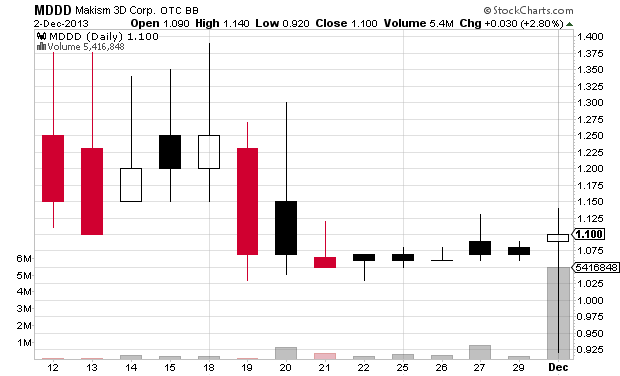

Previous closing price: $1.07

Market capitalization: $63 million

Excerpts from disclaimer:

Andy Chambers, Chambers Advisors Inc.(CAI) received $10,000 in cash compensation from Blackrock Media Group Inc. and its client Edge Strategies, LLC to endorse this advertisement in addition, Andy Chambers, Chambers Advisors Inc.(CAI) does expect to receive new subscriber revenue as a result of this advertising effort.

…

Blackrock Media Group Inc., (BMG) has received a total of $2,750,000 USD as of November 30th, 2013 from its client Edge Strategies, LLC., the third party advertiser for this advertising in an effort to build investor awareness for Makism 3D Corp. (OTCQB: MDDD). BMG shall retain any amounts over and above the cost of creating and distributing this advertisement

Disclaimer:

ENDORSER IMPORTANT NOTICE AND DISCLAIMER: Andy Chambers (Endorser) track record was compiled from calculations derived from documentation from the Compound Income Trader newsletter a Chambers Advisors Inc. (CAI) publication; Said publications and documentation were made available to CAI subscribers. No representation is made that actual purchases and sales were made at the prices stated. The Andy Chambers Advisors, The Market’s Line in the Sand Newsletter is a Chambers Advisors Inc. publication. Facts stated in this article were supplied to endorser from third-party sources. Andy Chambers, Chambers Advisors Inc.(CAI) received $10,000 in cash compensation from Blackrock Media Group Inc. and its client Edge Strategies, LLC to endorse this advertisement in addition, Andy Chambers, Chambers Advisors Inc.(CAI) does expect to receive new subscriber revenue as a result of this advertising effort. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this newsletter as the basis for any investment decision. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our publication is not trustworthy unless verified by their own independent research. Only invest monies you can afford to lose. Andy Chambers Chambers Advisors Inc.(CAI) makes no representations as to such facts, reliability, accuracy or completeness. Endorser is not responsible for errors or omissions. Endorser does not claim any special expertise or knowledge regarding the Printing industry. Endorser is neither acting as an investment advisor nor providing individual investment advice. Andy Chambers Chambers Advisors Inc.(CAI) OWNS NO SHARES,OPTIONS,WARRANTS in Makism3D Corp.(MDDD). Also, Makism3D Corp.has neither approved nor paid for this specific advertisement. Readers should perform their own due diligence. The information presented is provided for information purposes only and the endorsement is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities. Endorser has not taken any steps to ensure that the securities referred to in this report are suitable for any particular investor. Any securities referenced by Endorser may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments. Nothing in the endorsement constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal recommendation to you. Information, opinions and estimates referenced in the endorsement reflect a judgment at its original date of publication and are subject to change without notice. The price and value of the securities mentioned in the endorsement can fall as well as rise, and may have a high level of volatility. High volatility securities may experience sudden and large falls in their value, leading to losses. High volatility investments may also be difficult to sell. Similarly, it may prove difficult for you to obtain reliable information about the value or risks to which such an investment is exposed. The endorsement may provide the addresses of, or contain hyperlinks to, websites. Except to the extent to which the report refers to website material of Endorser, the Endorser has not reviewed any recommended or linked site and takes no responsibility for the content contained therein. Such address or hyperlink is provided solely for your convenience and information and the content of the linked site does not in any way form part of the endorsement. Accessing such websites or following any link shall be at your own risk. Further, you are advised to read and carefully consider the additional explanations of risk factors in Markism 3D Corp. SEC filings that can be found online in the SEC‚s EDGAR database at www.SEC.gov . Neither Andy Chambers nor his publication is offering securities for sale. Finally, Penny Stocks are EXTREMELY RISKY. You should consult with your registered investment adviser before investing to determine suitability and risk tolerance. Andy Chambers Chambers Advisors Inc.(CAI) assumes no risk for investor losses or profits. The information contained herein contains forward-looking information within the meaning of section 27a of the Securities Act of 1993, as amended, and section 21e of the Securities Exchange Act of 1934, as amended, including statements regarding expected growth of the featured company. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act, statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect Makism3D Corp. actual results of operations. Factors that could cause actual results to differ include size and growth of the market, the Company”s ability to fund its capital requirements in the near term and in the long term; pricing pressures, technology issues etc. There is no guarantee that past results are indicative of future performance. IMPORTANT NOTICE! Option and stock investing involves risk and is not suitable for all investors. Only invest money you can afford to lose in stocks and options. Past performance does not guarantee future results. The trade entry and exit prices represent the price of the security at the time the trade recommendation was made. The Andy Chambers Chambers Advisors Inc.(CAI) trade record does not represent actual investment results. Trade examples are simulated and have certain limitations. Simulated results do not represent actual trading. Since the trades have not been executed, the results may have under or over compensated for the impact, if any, of certain market factors such as lack of liquidity. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

Third Party Advertiser IMPORTANT NOTICE AND DISCLAIMER: Blackrock Media Group Inc., (BMG) has received a total of $2,750,000 USD as of November 30th, 2013 from its client Edge Strategies, LLC., the third party advertiser for this advertising in an effort to build investor awareness for Makism 3D Corp. (OTCQB: MDDD). BMG shall retain any amounts over and above the cost of creating and distributing this advertisement which advertises The Andy Chambers Advisor’s The Market’s Line in the Sand Newsletter (a publication of Andy Chambers Chambers Advisors Inc.) coverage of Makism 3D Corp. Advertising services include; production, outsourced advertising copywriting services, mailing and other related distribution services and advertising media placement costs. Blackrock Media Group, Inc. is a company based in Bacolod City, Philippines and its client Edge Strategies, LLC, third party advertiser, is a company based in Charlestown, Nevis. Edge Strategies, LLC, the third party advertiser, has represented to BMG in writing that it does not own any shares of Makism 3D Corp. except for restricted stock. Edge Strategies, LLC. has represented to BMG in writing that it will not sell, pledge or hypothecate or otherwise agree to dispose of for 90 days following the initial dissemination of this advertisement. Edge Strategies, LLC. has also represented to BMG in writing that neither it nor its affiliates will buy or sell any shares of Makism 3D Corp. during the period that this advertisement is being disseminated by BMG or third party media vendors. This is sponsored advertising and does not purport to provide an analysis of the featured company’s financial position, operations or prospects and is not to be construed as a recommendation or solicitation by BMG to buy or sell any security. BMG is a firm which refers and facilitates the services of third-party vendors and advertising related service providers to persons wishing to sponsor advertising that may feature or include publicly-traded companies. BMG is not a financial analyst, investment advisor or broker/dealer. The services provided by BMG in connection with this advertisement are limited to the introduction of third party advertiser to copywriter services and paid endorser, the renting of distribution list(s), and managing the production and distribution of this advertisement. BMG is not responsible for the endorsement of this advertisement, which is the sole responsibility of The Andy Chambers Advisor’s The Market’s Line in the Sand Newsletter. Andy Chamber`s Chambers Advisors Inc. expects to receive an unknown amount of subscription revenue as a result of this advertising effort. Neither BMG nor its members have an ownership interest in The Andy Chambers Advisor’s The Market’s Line in the Sand Newsletter or any of its affiliates, and neither The Andy Chambers Advisor’s The Market’s Line in the Sand Newsletter nor its affiliates have an ownership interest in BMG. BMG makes no warranties as to the accuracy of the content of this advertisement and expressly disclaims and assumes no liability for how readers may choose to utilize the content of this advertisement. Readers are strongly urged to independently verify all statements made in this advertisement and to perform their own due diligence on this or any other advertised company, including but not limited to consulting with a qualified investment professional and reviewing the publicly available financial statements of, and other information about Makism 3D Corp. You should also determine that an investment in Makism 3D Corp. is appropriate and suitable for you. Makism 3D Corp. is traded on the OTCQB Bulletin Board (trading symbol: MDDD). Its stock is registered under the Securities Act of 1933, as amended, and its periodic and other reports filed under the Securities Exchange Act of 1934, as amended, are publicly available from the Securities and Exchange Commission at its website at http://www.sec.gov. This website also contains general investor information about publicly-traded companies, advice to investors and other investor resources. Other investor resources are available from the Financial Industry Regulatory Authority through its website at www.finra.org. Many states have established rules requiring approval by the state securities administrator to permit sales of a security to its residents. Check with the North American Securities Administrators Association through its website at www nasaa.org or call your state securities administrator to determine whether a particular security may be purchased by you as a resident of your state. Many companies have filed information with state securities regulators and many companies will supply prospective investors with additional information upon request. Investing in securities is highly speculative and carries a great deal of risk, especially as to newer companies with comparatively short operating histories and limited earnings. This advertisement contains forward-looking statements regarding Makism 3D Corp. its business and prospects. Such forward-looking statements are within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to be covered by the safe harbor provisions created by these laws. This advertisement may provide the addresses of or contain hyperlinks to outside or third-party websites, BMG has not reviewed any such websites and takes no responsibility for the contents thereof or any possible effects resulting from accessing any such websites. The contents of any such websites do not in any way constitute a part of this advertisement. Accessing such websites or following any link shall be at your own risk.

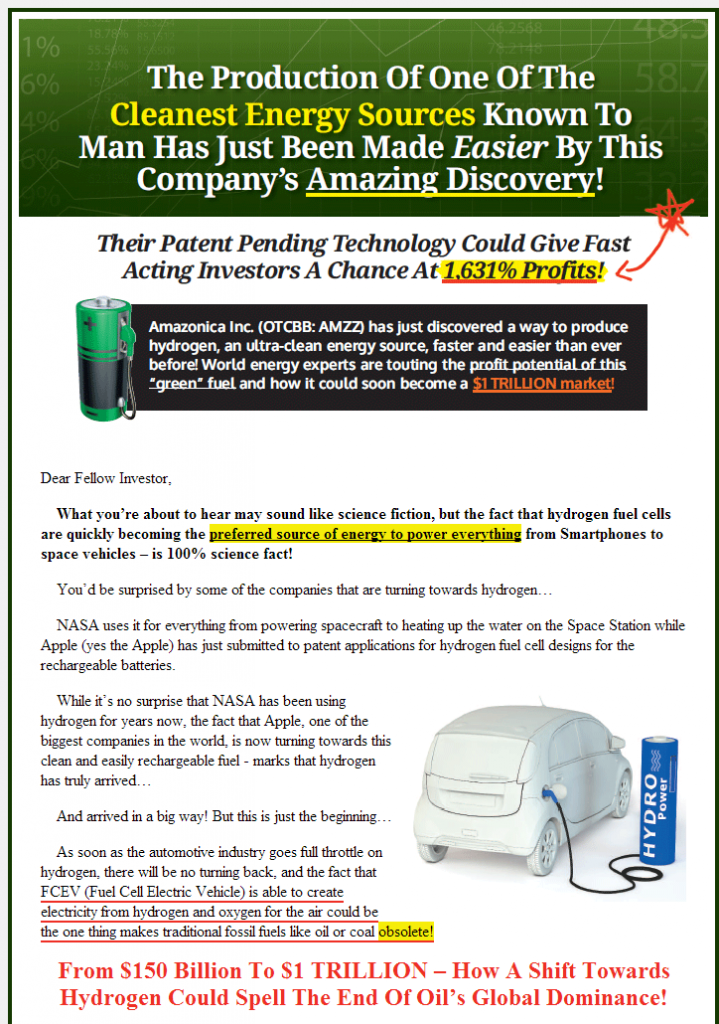

PDF copy of promotion website.

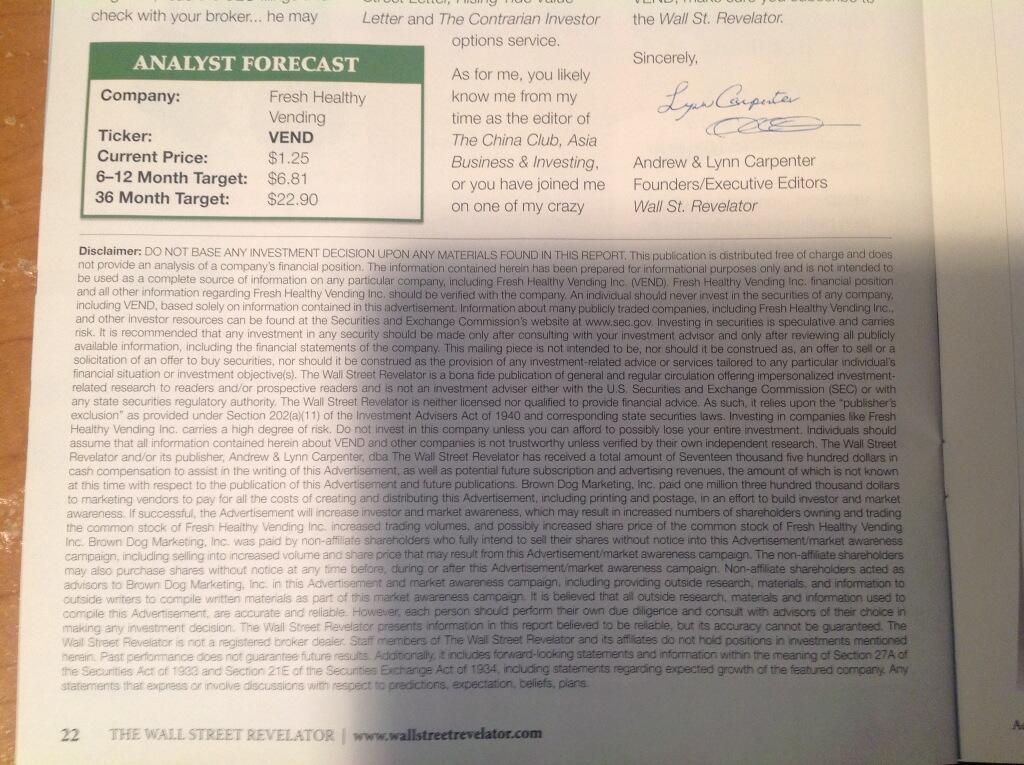

[Edit 2013-12-11]: There are hard mailers going out promoting MDDD. See the full mailer at Promotion Stock Secrets. Zen Trader posted good photos of the disclaimers. Read the Promotion Stock Secrets report on MDDD, which is now available to non-subscribers.

See Ivan’s article on SeekingAlpha about the MDDD pump and dump.

Disclaimer: [Edit 2013-12-12: I have no position in MDDD]; my position will likely change by the time you read this and I will not update this disclaimer unless I update the post; I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.