Yesterday The Alkaline Water Company Inc. (WTER) had big trading volume of 1.9 million shares and at its high was up over 20%. Tim Lento noticed that and found the landing page for a promotion of the company at WTERReport.com. After he posted it the page was taken down. That website currently shows “under construction.”

Disclosed budget: “up to” $3,000,000

Promoter: Investech Equity and Francis Gaskins

Paying party: Investech Equity

Shares outstanding: 79,387,175

Previous closing price: $0.55

Market capitalization: $43 million

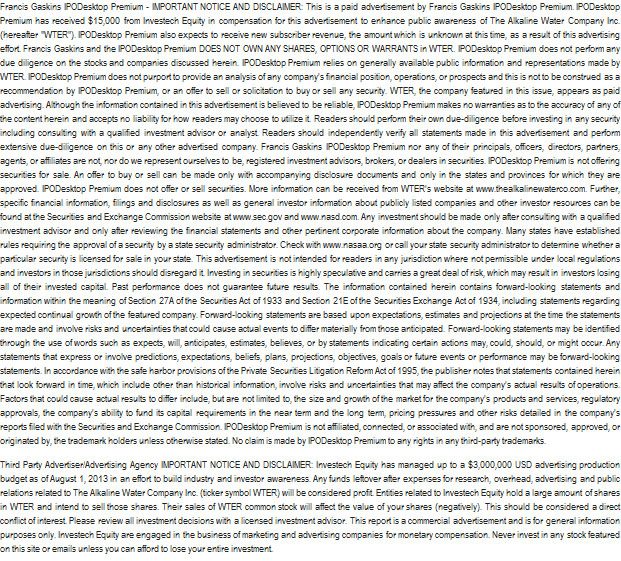

[Edit 2013-8-22]: Francis Gaskins / IPODesktop Premium now disclose that they were not compensated in the updated disclaimers. The old disclaimers will remain copied below for archival purposes. Previously, the disclaimer said, “IPODesktop Premium has received $15,000 from Investech Equity in compensation for this advertisement to enhance public awareness of The Alkaline Water Company Inc.” The current disclaimer is copied below. As to what this means, I do not know. Being involved in the promotion of a worthless pump and dump company looks bad to me whether an endorser gets paid or not.

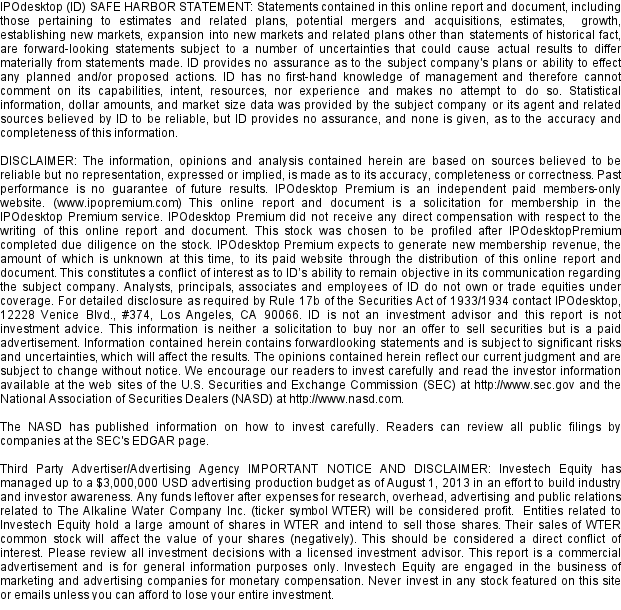

Excerpt from disclaimer:

IPOdesktop Premium did not receive any direct compensation with respect to the writing of this online report and document. The stock was chosen to be profiled after IPOdesktop Premium completed due diligence on the stock. IPOdesktop Premium expects to generate new membership revenue, the amount of which is unknown at this time, it its paid website through the distribution of this online report and document.

…

Investech Equity has managed up to a $3,000,000 USD advertising production budget as of August 1, 2013 in an effort to build industry and investor awareness. Any funds leftover after expenses for research, overhead, advertising and public relations related to The Alkaline Water Company Inc. (ticker symbol WTER) will be considered profit. Entities related to Investech Equity hold a large amount of shares in WTER and intend to sell those shares. Their sales of WTER common stock will affect the value of your shares (negatively).

PDF copy of promotion page.

Embedded in the promotion page is this Youtube video of Francis Gaskins talking positively about WTER. The video was uploaded to Youtube on August 7th by someone who had not previously uploaded any videos.

New disclaimer:

Old Disclaimer:

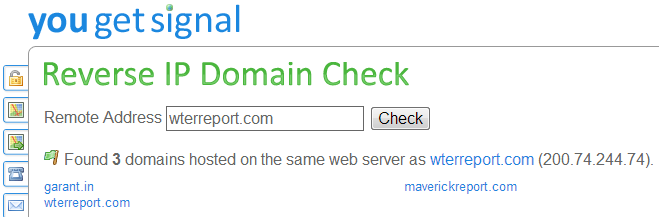

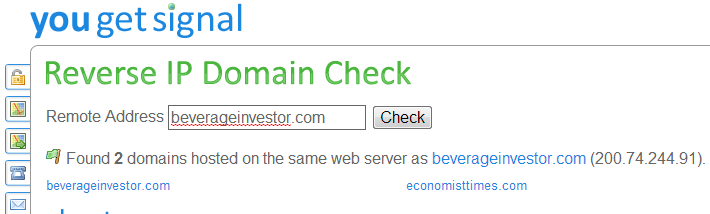

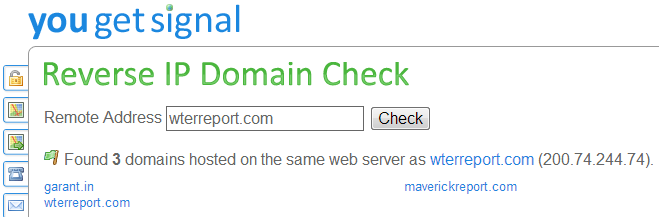

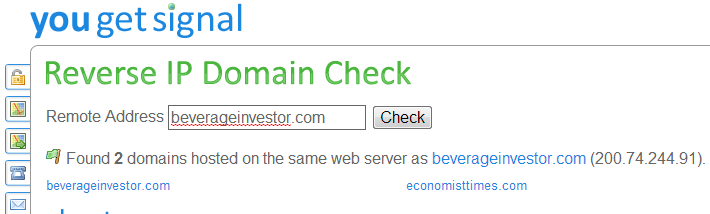

[Edit 2013-8-19]: As of the middle of last week the WTERReport.com website was back up. I have since a few other websites promoting WTER. Looking at the other websites on the same server as WTERReport.com (using YouGetSignal). Below is a screenshot of the result, showing one defunct website (Garant.in) and one stock promotion website (MaverickReport.com).

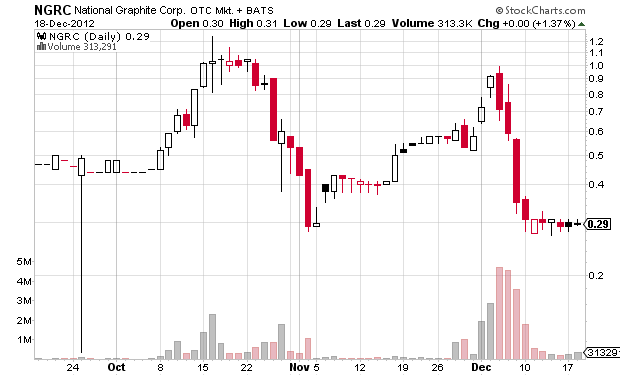

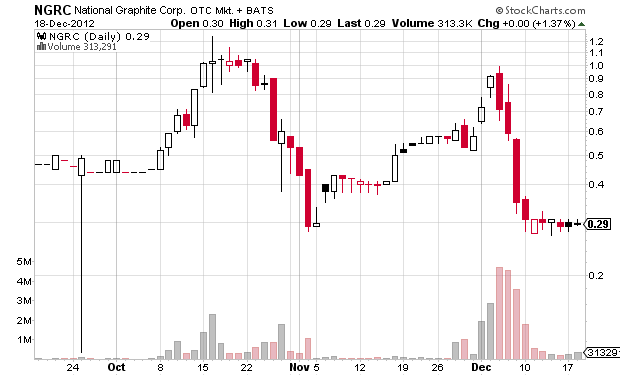

I signed up for the MaverickReport.com newsletter and my confirmation email was from publisher@outoftheboxstox.com. The CANSPAM-required information at the bottom of the email revealed the sender to be “Investech Equity, Pacific Place, 1 Queens Road East, Admiralty, Hong Kong, Hong Kong.” I had run across a promotion by OutoftheBoxStox.com before so I looked through my emails to see what they had previously promoted. They previously promoted NGRC in September and October of 2012.

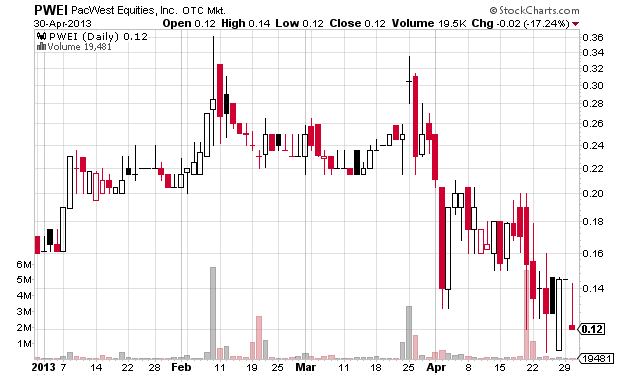

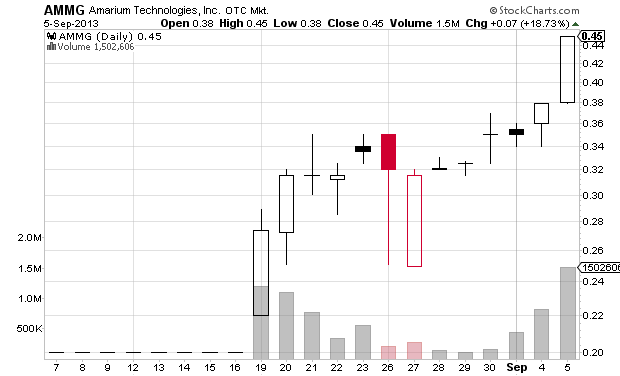

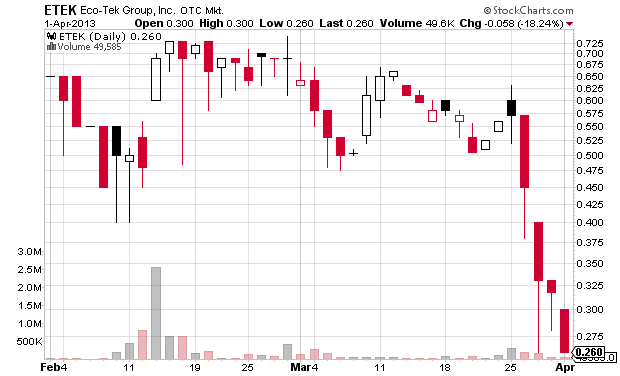

Below is a chart of NGRC. While the stock did have a nice move during the first pump it didn’t last that long and dropped big.

One of the problems (or benefits) of the internet domain name system is that changes take awhile to propagate. So if a change is made, different websites may display different information. That is the case with OutoftheBoxStox.com. While my favorite website didn’t display any other websites as being at the same IP as OutoftheBoxStox.com, DomainTools.com did; it showed MountStockMore.com as being hosted on the same server. Of course if I weren’t so cheap I would pay for a premium subscription to DomainTools.com or a similar website so I could see which websites used to be on the same server.

I then went to MountStockMore.com and signed up. The email signup confirmation page included a link to a BeverageInvestor.com profile of WTER. After looking at that website it is clear that it exists solely to promote WTER. A look at the disclaimer shows that it is exactly the same as the disclaimer at WTERReport.com.

BeverageInvestor.com disclaimer:

PDF copy of BeverageInvestor WTER pump page.

After looking that over it was time to go back through the steps I went through earlier on this new domain name:

That led me to EconomistTimes.com, which is of course reminiscent of other fake online newspapers such as FinancierTimes.com and ChicagoFinancialTimes.com (now defunct). A reference to The Economist Times could also be found in the disclaimer at the bottom of MountStockMore.com:

(click to enlarge)

A quick look at the home page of The Economist Times led me to the promotion page on WTER: http://www.economisttimes.com/wter_report/ Once again the disclaimer at the bottom is the exact same as that of WTERReport.com and BeverageInvestor.com:

PDF copy of EconomistTimes WTER pump page.

It seems that online promotions like this are getting more and more complex. It used to be that there would be a promotion website linking to a fake news article. Now we have multiple promotion websites linking to multiple different fake articles.

Besides the blatantly obvious WTERReport.com (that Tim Lento was the first to notice when it first went live), this promotion of WTER involves four different websites:

MaverickReport.com

EconomistTimes.com

BeverageInvestor.com

MountStockMore.com

[Edit 2013-8-22]: Search ads and display ads are now beginning to appear promoting WTER. Thanks to Tom McCarthy of PrePromotion Stocks for pointing this out.

Also, Outoftheboxstox.com has sent teaser emails indicating their next promotion will come on August 26th through August 30th (different dates to different emails). See the screen capture of the email below:

Disclaimer: [Edit 2013-8-22] I have no position in any stock mentioned. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.