Yesterday the SEC sued four promoters for manipulative trading in marijuana stocks and the Department of Justice joined the fun with a criminal case against three of the four. First I address the more serious criminal charges (see DoJ press release). The criminal charges relate to only one stock: ISM International (ISML).

Three men who allegedly manipulated penny stocks, and then laundered the proceeds by purchasing precious metals, were charged today in U.S. District Court in Tacoma with conspiracy to commit securities fraud and conspiracy to launder monetary instruments, announced U.S. Attorney Jenny A. Durkan. MIKHAIL GALAS, 24, of Vancouver, Washington was arrested in Long Beach, California after he arrived on a flight from Portland, Oregon. He will make his initial appearance in U.S. District Court in Los Angeles. CHRISTOPHER MROWCA, 24, was arrested in Bradenton, Florida and will make his initial appearance in Tampa. ALEXANDER HAWATMEH, 23, of Salem, Oregon is incarcerated in Oregon on an unrelated charge and will appear in federal court at a later date. In addition to the arrests, searches were conducted in Vancouver, Washington, Bradenton, Florida, Salem, Oregon and Boulder, Colorado.

Below is the criminal complaint against those three individuals:

USA v. Mrowca Et Al Doc 1 Filed 01 Aug 14 by Shannon Coleman

Of note: Christopher Mrowca controls Money Runners Group LLC, a scummy and generally ineffective stock promoter. Money Runners has their own InvestorsHub messageboard and website. Alexander Hawatmeh is a former member of Worthmore Investments LLC, the company that runs the StockHaven stock promotion and stock chat website (at least according to statements on the Stockhaven website). [Edited 2017-7-25: removed dead links to Stockhaven website (which has been defunct for years) and removed the names of others who were involved with Stockhaven who were not named in the above complaint. Also, I should note that Stockhaven/Worthmore were not mentioned in the SEC or criminal complaints.]

The SEC complaint includes five stocks, including PHOT and HEMP from early this year. It also includes a fourth individual, Tovy Pustovit:

Defendant Pustovit, age 20, is a resident of Vancouver, Washington. Pustovit was

5 the registered owner of a stock promotion website called “Explosive Alerts” from August 2012,

6 when the site was created, until August 2013.

Excerpt from SEC press release:

The SEC’s complaint filed in federal court in Tacoma, Wash., charges the following individuals:

- Mikhail Galas, a stock promoter who lives in Vancouver, Wash.

- Alexander Hawatmeh, a member of Worthmore Investments LLC, which owns a stock promotion website called stockhaven.com. He formerly lived in Vancouver and currently resides in Lincoln City, Oregon.

- Christopher Mrowca, a stock promoter who operates Money Runners Group LLC, which has an affiliated stock promotion website called MoneyRunnersGroup.com. He lives in Bradenton, Fla.

- Tovy Pustovit, who owns a stock promotion website called Explosive Alerts. He also lives in Vancouver.

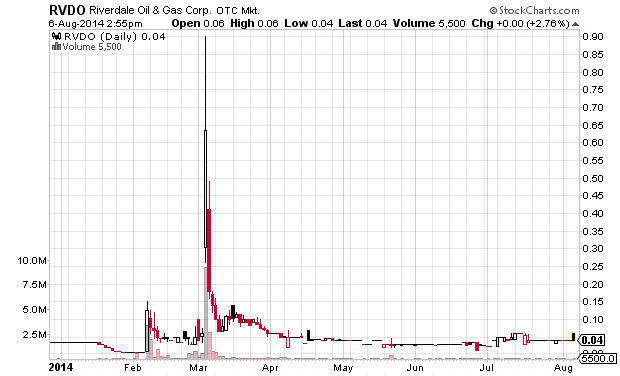

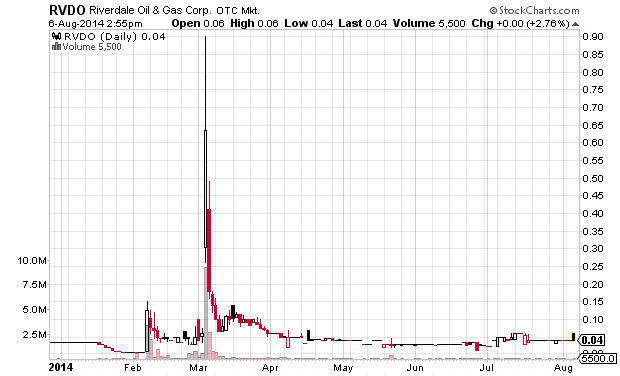

See the SEC complaint (PDF). The most profitable of all the stocks mentioned in the suits is RVDO:

142. On March 5, 2014, there was a promotion of RVDO over the Internet claiming

6 that RVDO would trade at $2 per share. The closing price of RVDO on March 4, 2014 was $.06

7 per share. This claim was misleading because there was no business development at RVDO that

8 would justify such a rise in price.

9 143. A. Hawatmeh had prior knowledge of the RVDO promotion and its timing.

10 144. Between 9:30 AM and 09:52 AM Eastern Time on March 5, 2014, A. Hawatmeh

11 sold approximately 3.23 million shares of RVDO common stock at prices ranging from $.28 per

12 share to $.90 per share.

13 145. A. Hawatmeh’s average selling price per share on March 5, 2014 was

14 approximately $.4375 per share, almost an eightfold increase over his average purchase price per

15 share.

16 146. A. Hawatmeh’s gross profits from trading RVDO between February 7, 2014 and

17 March 5, 2014 were over $1.23 million.

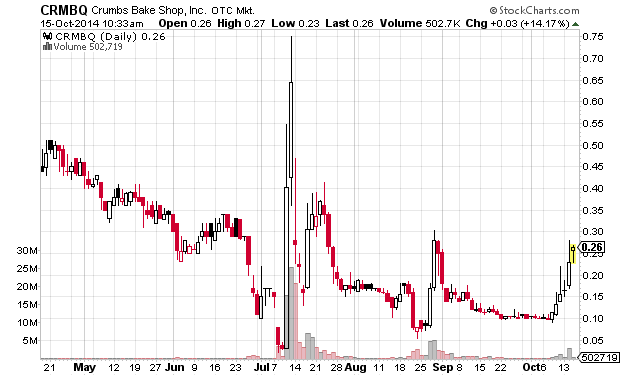

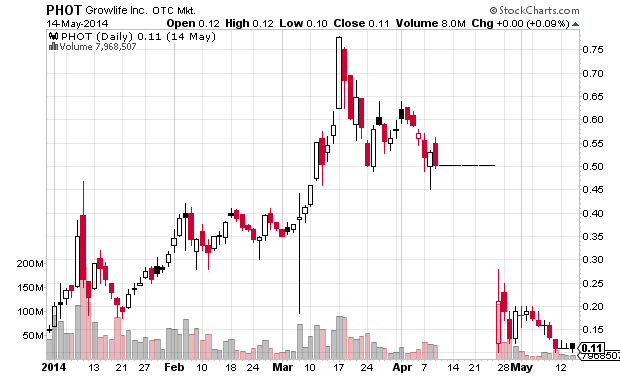

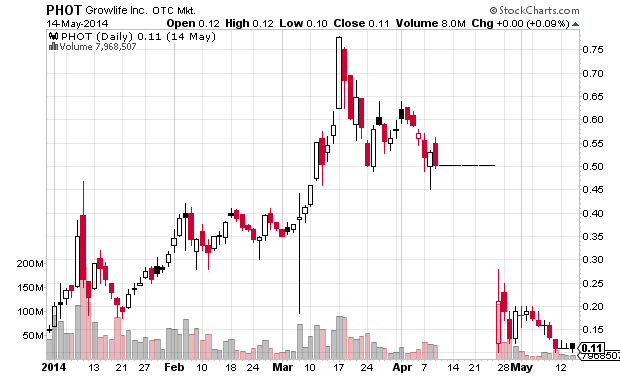

Perhaps the most interesting of all the promotions though are HEMP and PHOT, because they were very liquid during the period the accused were actively trading the stock. First, the details of PHOT:

Trading in PHOT

90. From January 9 to January 14, 2014, there was an Internet promotion of PHOT as part of a broader promotion of several marijuana-related stocks.

91. During that promotion, Mrowca and Galas traded approximately 6.4 million shares of PHOT common stock, and during and leading up to the promotion engaged in manipulative trading designed to increase the price and volume of PHOT common stock.

92. From January 2, 2014 through January 14, 2014, Mrowca engaged in wash trades of PHOT common stock and also engaged in matched orders of PHOT common stock with Galas

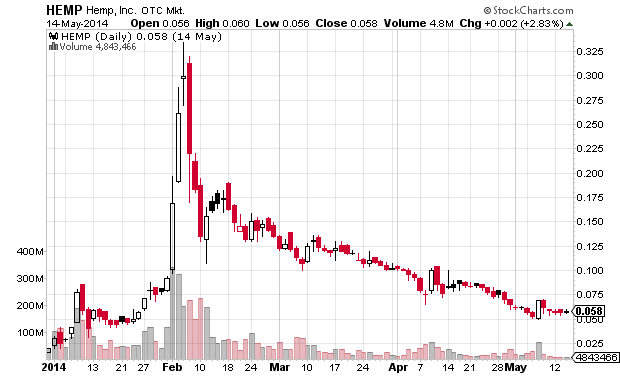

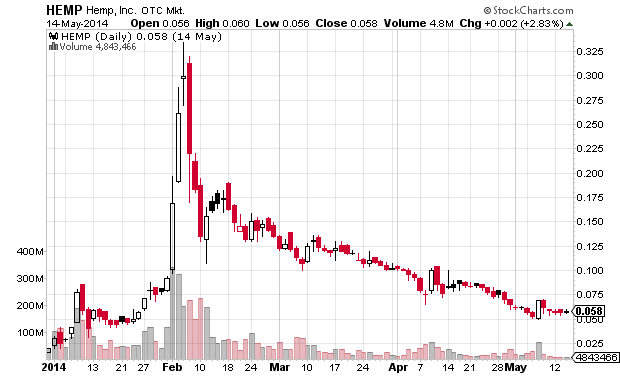

It is important to note that the defendants bought HEMP after it had already had its first run up to a high of just over $0.08 from under $0.02 at the beginning of 2014 — they started buying on January 23rd when the price was about $0.05. Even if they had not allegedly engaged in manipulative trading they likely would have made a lot of money.

Trading in HEMP

117. A. Hawatmeh, Galas and Mrowca began accumulating HEMP common stock

through market purchases on January 23, 2014. Between January 23, 2014 and February 12,

2014, A. Hawatmeh, Galas, and Mrowca bought and sold approximately 41.7 million shares of

HEMP common stock.

118. During the period from January 24 through February 12, 2014, HEMP was actively promoted on the Internet.

119. For example, on February 6, 2014, one Internet tout claimed that HEMP could reach “a REAL Possible Gain of OVER 2900%.”

120. During the promotion, A. Hawatmeh, Mrowca and Galas engaged in manipulative wash trades and matched orders of HEMP common stock.

121. The total trading volume for HEMP common stock in the A. Hawatmeh, Mrowca,and Galas accounts during this period was approximately 83 million shares.

Disclaimer: I have no position in any stock mentioned above. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.