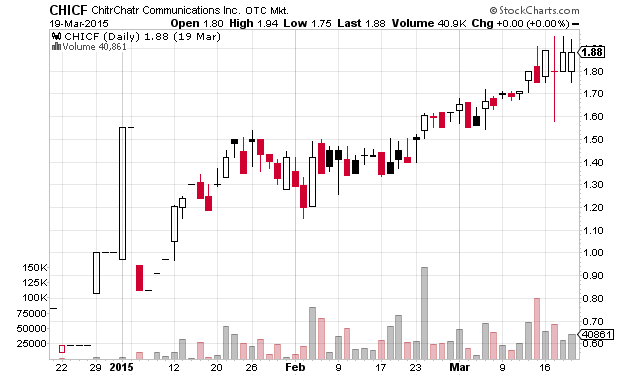

This morning prior to the market open the SEC suspended trading in recent online landing page pump and dump ChitrChatr (CHICF). ChitrChatr never got much volume which is why I had not previously blogged about the pump. Trading will resume at the market open on Friday, April 3rd.

SEC Suspension notice (PDF)

SEC Suspension order (PDF)

The reason given for the trading suspension:

The Commission temporarily suspended trading in CHICF due to questions regarding recent volatile trading activity and questions regarding the adequacy and accuracy of information in a company press release dated January 21, 2015 relating to the company’s financing and the source of that financing.

The SEC acknowledges the assistance of the Alberta Securities Commission and of FINRA in this matter.

CHICF received a cease trade order (CTO) from the Alberta Securities Commission on March 11th).

You can read the January 21st press release.

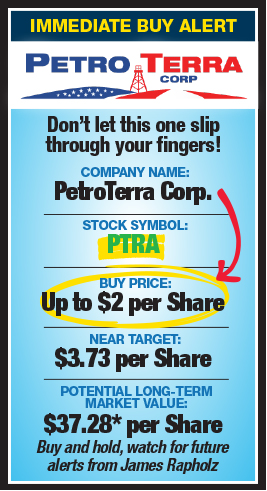

Information on the pump is below:

CHICF was first promoted back in April and May of 2014 and started getting repumped beginning on January 22nd, 2015. The landing page promoting CHICF is at http://www.yoursmarttrade.com/chicf.html

Disclosed budget: not disclosed ($5,000 to Intelligent Investor Report)

Promoter: Intelligent Investor Report

Paying party: TLC Communications

Shares outstanding: 31,450,000

Previous closing price: $1.88

Market capitalization: $59 million

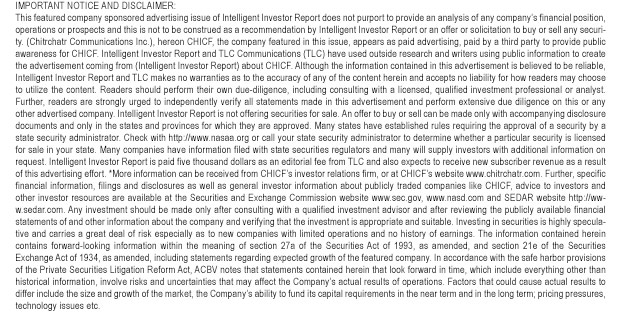

Excerpt from disclaimer:

Intelligent Investor Report and TLC Communications (TLC) have used outside research and writers using public information to create the advertisement coming from (Intelligent Investor Report) about CHICF.

…

Intelligent Investor Report is paid five thousand dollars as an editorial fee from TLC and also expects to receive new subscriber as a result of this advertising effort

Full disclaimer:

PDF copy of promotion page

Disclaimer: I have no position in any stock mentioned. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.