Randy Hamdan, a stock promoter currently being sued by the SEC, has sued SeekingAlpha author Matt Finston for libel. See the article on SeekingAlpha that led to this. The case was filed in the Eastern District of Michigan; the case number is 2:14-cv-12949-GAD-MKM. I saved a copy of the complaint and all exhibits (PDF). Finston is asking for support in defending against this suit. Below is an excerpt from the complaint:

8. Just a few examples of Defendant’s false and defamatory statements regarding Plaintiff are as follows: a. That Plaintiff has a “fraudulent past”. (See Exhibit A).

b. That Plaintiff and HH Group, LLC were issued 420 Million shares of stock in Creative Edge Nutrition Inc. (ticker symbol FITX) for $0.001 per share. (See Exhibit B).

c. That “Vgpr didn’t survive Hamden”, implying that Plaintiff caused Vega Biofuels Inc. to fail or go out of business. (See Exhibit C).

d. That “DNAX is another”, implying that Plaintiff caused DNA Brands, Inc. to fail or go out of business. (See Exhibit D).

e. That Plaintiff “dumped” FITX stock “into the promotion three years ago”. (See Exhibit E).

f. That Plaintiff is “a serial pump and dump and he’s been charged by the SEC for it.” (See Exhibit F).

g. That Plaintiff is “a known pump and dump”. (See Exhibit G).

h. That Plaintiff is “an investor relations ponzi”. (See Exhibit H).

…

j. That Plaintiff is “using more profiles to harass and intimidate and pump”. (See Exhibit J).

Below I examine each of these claims. Do note that I am not a lawyer so my opinion may not be the most informed on whether Hamdan has a good case or not.

a. “That Plaintiff has a “fraudulent past”.

While my lawyers would not like me to use these words if there has not been a criminal fraud conviction, the actions that Randy Hamdan is alleged to have engaged in by the SEC clearly fit the common definition of fraud even if he was not criminally charged with fraud (highlighting mine; excerpted from SEC legal complaint against Hamdan):

Randy A. Hamdan (“Hamdan”) began the scheme by creating a market with manipulative purchases and sales of the securities of CompuSonics in September 2009 through his wholly owned entity, Oracle Consultants, LLC (“Oracle Consultants”), and continued it with a marketing campaign that began in early October 2009 and culminated on October 19, 2009 with the issuance, by an international news distribution service, of a false press release regarding the company’s purported positive business developments

If Finston had used the modifier “allegedly” (because Hamdan has not settled or lost the case yet), his statement would be substantially true. If Hamdan does settle the SEC suit or loses it then he would have no cause for action on the basis of that statement.

b. That Plaintiff and HH Group, LLC were issued 420 Million shares of stock in Creative Edge Nutrition Inc. (ticker symbol FITX) for $0.001 per share. (See Exhibit B).

This is a true fact. Below are excerpts from the 2013 FITX annual report list of share issuances:

Shareholder | Number of shares issued | price

HH Group LLC. 3/4/2013 32,000,000 0.001 conversion Restricted

HH Group LLC. 3/4/2013 28,000,000 0.001 conversion Restricted

HH Group 5/5/2013 36,500,000 0.001 Paid debt Restricted

HH Group 5/8/2013 10,000,000 0.001 services Restricted

HH Group 5/15/2013 72,000,000 0.001 Paid line of credit off Restricted

HH Group LLC. 7/9/2013 52000000 0.001 Paid debt Restricted

HH Group LLC. 7/9/2013 10000000 0.001 Paid debt Restricted

HH Group LLC. 7/9/2013 5000000 0.001 Paid debt Restricted

HH Group LLC. 7/9/2013 20000000 0.001 Paid debt Restricted

Rhamdan 8/21/2013 10204081 0.001 Paid debt Restricted

Rhamdan 8/21/2013 10204081 0.001 Paid debt Restricted

Rhamdan 8/21/2013 20408163 0.001 Paid debt Restricted

Rhamdan 9/6/2013 50000000 0.001 Paid debt Restricted

HH Group, LLC 9/6/2013 10204081 0.001 Paid debt Restricted

HH Group, LLC 9/6/2013 10204081 0.001 Paid debt Restricted

HH Group, LLC 9/6/2013 40816326 0.001 Paid debt Restricted

c. That “Vgpr didn’t survive Hamden”, implying that Plaintiff caused Vega Biofuels Inc. to fail or go out of business. (See Exhibit C).

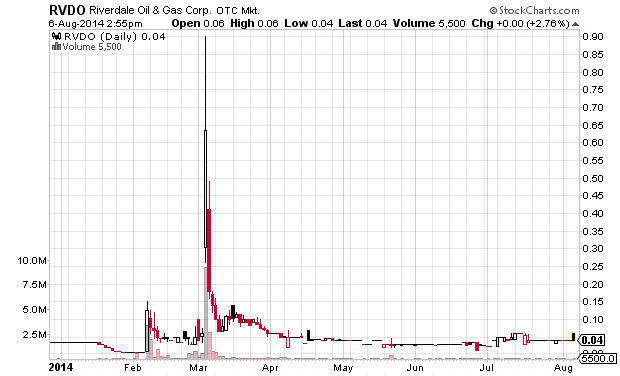

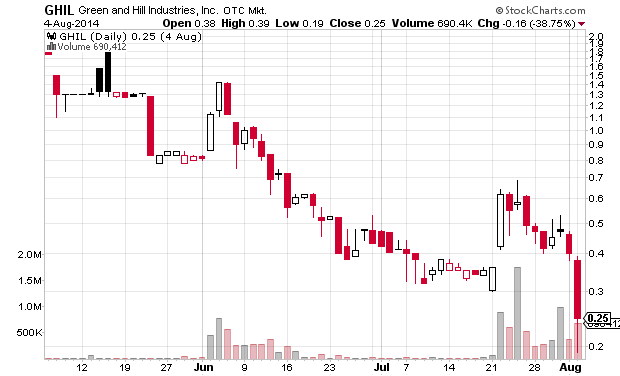

Vega Biofuels (VGPR) is still in business. However, if Finston meant that the stock price declined as a result of Hamdan, then his statement is correct. Selling by shareholders into paid promotions causes stocks to fall. Hamdan’s company paid for some promotion of VGPR. Example below:

StockRockandRollLLC® has been compensated three thousand cash for one-day coverage on VGPR by HH Group LLC. [excerpt from email received from stockloackandload.com.com on 4/20/2011]

d. That “DNAX is another”, implying that Plaintiff caused DNA Brands, Inc. to fail or go out of business. (See Exhibit D).

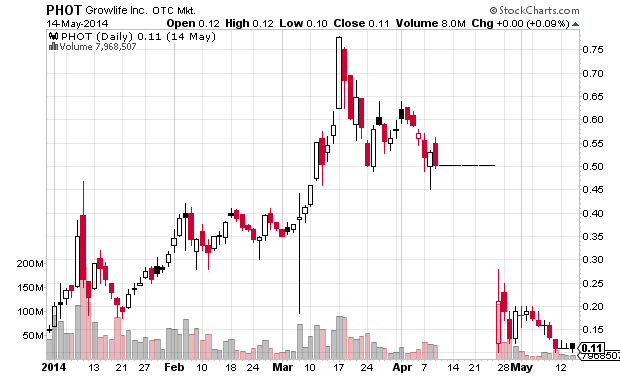

As with Vegas Biofuels, it is clear that while the company didn’t go out of business, the stock price dropped substantially, at least partially as a result of shareholders selling into the stock promotion that was at least partly paid for by Hamdan’s company HH Group LLC. See excerpt from a promotional email below:

Market Wrap Media, Inc. accepts compensation from companies for advertising services.

Market Wrap Media, Inc. has been contracted to receive $2,500 by a third party (HH Group LLC) for 1 day of advertising service for DNAX. [excerpt from email received from pennystocknewspaper.com on 11/30/2011]

e. That Plaintiff “dumped” FITX stock “into the promotion three years ago”. (See Exhibit E).

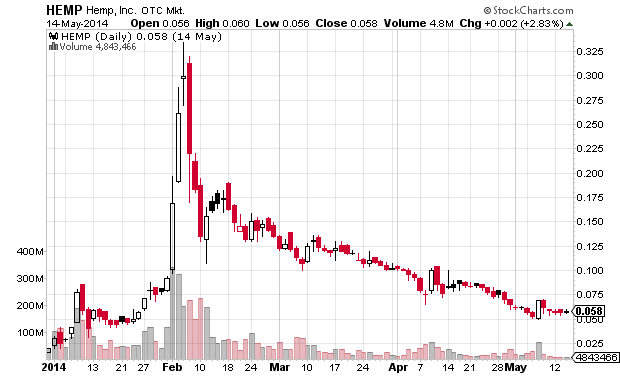

This is the point of a stock promotion: to enable large shareholders to sell shares. It is a true fact that Hamdan owned (and continues to own) millions of shares and that his company HH Group LLC paid for numerous promotional emails promoting FITX back in 2012. Unless Hamdan and his companies did not sell any shares during the promotions this is a substantially true statement. While 2012 is only two years ago and not three, it is close enough for the statement to be substantially true and thus not libelous. Below is an excerpt from just one of many promotional emails on FITX I received in 2012, paid for by Hamdan’s HH Group LLC:

We expect to be compensated fifteen thousand dollars by a non-affiliate third party, HH Group, LLC, for a one week advertisement of Creative Edge Nutrition, Inc. [excerpt from email received from ExplosiveOTC.com on 110/1/2012]

f. That Plaintiff is “a serial pump and dump and he’s been charged by the SEC for it.” (See Exhibit F).

This is a true fact: Hamdan and his companies have paid for stock promotion on many companies (more than just the three that Finston mentioned). Paying for stock promotion and then selling shares is the very definition of a pump and dump. The SEC sued Hamdan for his role in the pump and dump of Compusonics in 2009:

FACTS Fraudulent Stock Marketing Campaign 8. From September 27, 2009 through October 19, 2009, Hamdan carried out a fraudulent marketing campaign designed to increase the trading price of CompuSonics’ stock. In substance, the fraudulent marketing campaign was to the effect that CompuSonics would soon release information concerning a settlement of a patent infringement matter that would “reward” shareholders. Hamdan caused the dissemination of materially false information concerning CompuSonics by means of stock newsletters, a website, a message board, and a press release. To facilitate the dissemination of the false information and conceal his role in the scheme, Hamdan employed an anonymous email service, a proxy server, and fictitious contact information.

g. That Plaintiff is “a known pump and dump”. (See Exhibit G).

This is a true fact (if you ignore Finston’s abuse of the English language): Hamdan’s companies have paid for multiple stock promotions.

h. That Plaintiff is “an investor relations ponzi”. (See Exhibit H).

This statement is meaningless hyperbole but even if it was libelous it was not made by Finston — he simply linked to a publicly accessible accusation by another individual.

[i. I have removed this complaint from this blog post and have removed my analysis of it. I believe that Finston made this comment to Hamdan and no one else saw it and it is thus not actionable. There is no need for me to further publicize it.]

j. That Plaintiff is “using more profiles to harass and intimidate and pump”. (See Exhibit J).

At least according to one message board poster I trust, Randy Hamdan has sent some nasty private messages to people and it would be reasonable to believe that the purpose of those messages was to intimidate. Oh, and meet “Michael Cheeseman” who appears to be Randy Hamdan.

So after looking at all the claims made by Randy Hamdan I conclude that his case is very weak. I may be wrong about that as I am not an expert.

Disclaimer: I have no position in any stock mentioned although I have traded FITX in the past. I have donated $400 to support Finston’s defense and I am in talks with him to further support his defense. This disclaimer will not be updated unless I update the blog post. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.