Today the SEC suspended trading in Face Up Entertainment (OTCBB: FUEG), a stock that has been pumped and dumped and repumped countless times. FUEG was most recently promoted by WFWS Consulting Inc (WhisperfromWallstreet.com / OTCStockExchange.com) and Stock Appeal LLC websites (LiquidPennies.com / VIPStockAlerts.com / HeroStocks.com /StockHunter.us / StockBrain.net). It appears that the SEC has become more aggressive in suspending trading in active stock promotions: EDVP was suspended one month ago.

WFWS Consulting Inc. has been paid $5,000 cash by Stock Appeal LLC.

for the purpose of increasing public awareness of FUEG

Currently, Stock Appeal LLC has been compensated up to $35,000 USD for increased public awareness of FUEG by a Compass Capital LTD, third party.

SEC suspension notice (pdf)

SEC suspension order (pdf)

The reason for the suspension:

The Commission temporarily suspended trading in the securities of Face Up because of

questions concerning the adequacy and accuracy of publicly available information about Face

Up, including, among other things, its financial condition, the control of the company, its

business operations, and trading in its securities.

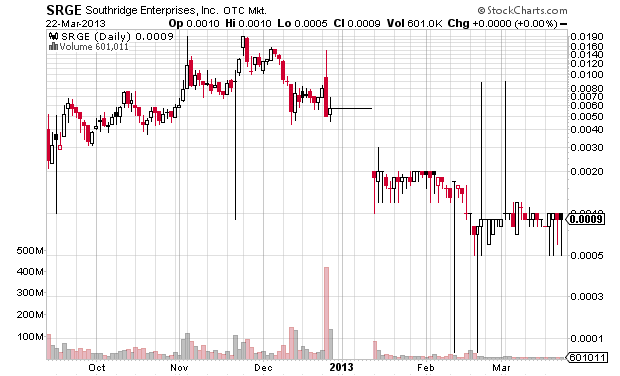

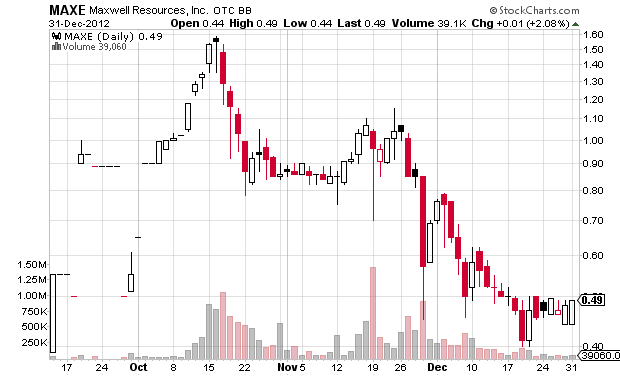

1 year chart of FUEG (click to embiggen):

[Edit 2013-4-5]: FUEG Insiders arrested and criminal complaint unsealed:

DOJ press release

Criminal complaint (pdf)

Excerpt from the press release (that quoted the criminal complaint):

FUEG was a publicly traded company that was purportedly involved in the reality gaming social network market with its principal place of business located in Valley Stream, New York. As captured through judicially authorized wiretap interceptions, the defendants coordinated control over a significant portion of FUEG shares and then promoted the stock through the dissemination of false press releases sent over the Internet. In addition, the defendants coordinated trading of FUEG shares to create the impression of increased trading volume to make FUEG appear to be an attractive purchase for unsuspecting investors. However, the defendants were unable to reap a profit from trading FUEG stock timed to the promotions, and their scheme ultimately failed.

As a result of the failed promotion of FUEG stock, GOLDSHMIDT, PUZAITZER, VAX, ORENA, GROSSMAN, AKSANOV, and KOIFMAN conspired to extort one of their co-conspirators, referred to as “CC-1” in the Complaint. In the summer of 2012, AKSANOV, KOIFMAN, GOLDSHMIDT and PUZAITZER met with CC-1 in New York, New York, and demanded that CC-1 pay them $350,000 and return shares of FUEG, or AKSANOV would “put slugs into” CC-1’s chest.

In several subsequent telephone calls and meetings, various defendants continued to demand that CC-1 repay them for their stake in the failed FUEG scheme, or they would harm CC-1. During a meeting on or about March 5, 2013, GOLDSHMIDT, PUZAITZER, ORENA and VAX met with CC-1 at a hotel in New York City and further threatened CC-1 and CC-1’s family if CC-1 did not comply with their demands.

The suspension is likely related to the numerous press releases that FUEG has put out over the last couple months:

- Face Up Entertainment Group, Inc. in Discussions to Introduce Rake Where Legal to Its Subscription Poker Platform GlobeNewswire (Thu 8:00AM EDT)

- Face Up Entertainment Group, Inc. Teams Up With Texas Hold’em Poker Tours (THPT) GlobeNewswire (Wed, Apr 3)

- Face Up Entertainment Group, Inc. Will Collaborate With Bad Beat on Hunger, Inc. GlobeNewswire (Wed, Mar 13)

- Face Up Entertainment Group, Inc. Looks to Benefit From Nations First Online Gambling Bill GlobeNewswire (Wed, Feb 27)

- Face Up Entertainment Group, Inc. Sees Its Subscription Based Model as a Solution to Monetization Issues Challenging the Social Gaming Market GlobeNewswire(Thu, Feb 21)

- Face Up Entertainment Group, Inc Seeks a Slice of the 2014 Projected $8.64 Billion Social Gaming MarketGlobeNewswire(Wed, Feb 20)

- Face Up Entertainment Group, Inc. Sees Future Growth and Opportunity in Bar Poker Leagues All Over the NationGlobeNewswire(Fri, Feb 15)

- Face Up Entertainment Sees States Leading Fight to Legalize On-Line Poker PlayGlobeNewswire(Tue, Feb 12)

- Face Up Entertainment Aims to Bring Its Legal Online Gaming Platform to FacebookGlobeNewswire(Fri, Feb 8)

Disclaimer: I have no position in any stock mentioned. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.